Virtual Real Estate: Beyond Hype, Into Value

For affluent investors looking for assets that are independent of market trends and innovative prospects, virtual real estate has established itself as a legitimate opportunity rather than a fleeting fad. In contrast to volatile cryptocurrency trading, virtual properties—ranging from metaverse parcels to online retail locations—possess inherent worth grounded in community engagement, functionality, and rarity, fitting perfectly with the long-term, quality-oriented perspective of astute wealth custodians.

Location, Location, Utility: The New Investment Mantra

Within the metaverse, the term "location" transcends mere geographical coordinates—it encompasses functionality. Prime virtual properties are situated near areas with high foot traffic, such as digital concert venues, flagship luxury brand offices, or exclusive social clubs. For investors, this indicates assets that produce regular income via rentals, event hosting, or advertising spots. A strategically located digital space can offer returns that rival those of physical properties while eliminating maintenance expenses, thus making it an efficient addition to diverse investment holdings.

Exclusivity as a Value Driver

Scarcity has always been the cornerstone of luxury, and virtual real estate enhances this principle. Numerous metaverse platforms impose limits on land availability, transforming sought-after parcels into finite resources. Affluent investors aim not merely to purchase digital land but to gain access to elite circles. Consider the advantage of owning a plot next to a virtual yacht club or a digital art institution; such closeness increases social value and asset worth, establishing a continuous cycle of exclusivity.

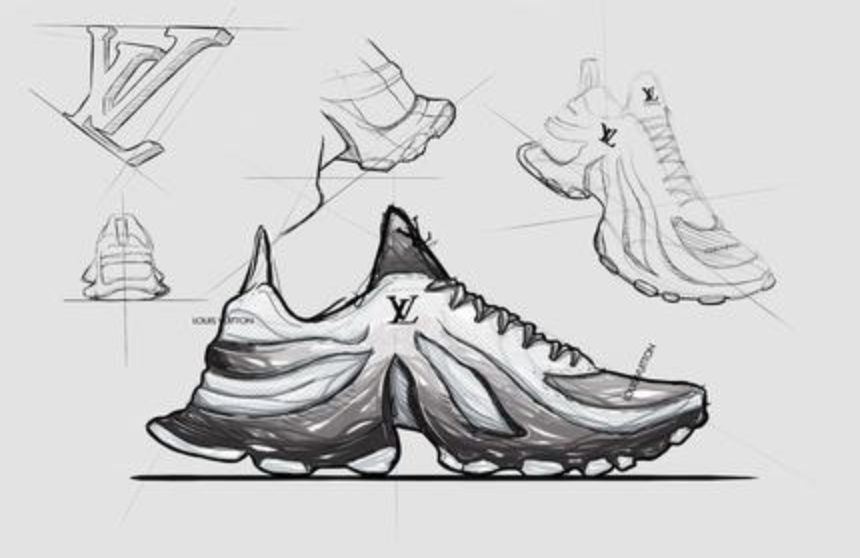

Innovative luxury brands are combining real-life experiences with digital offerings, with virtual real estate serving as the connector. A fashion brand might release limited-edition NFTs that provide entrance to a virtual boutique on a coveted metaverse site, where owners can "don" digital garments and partake in online fashion showcases. For investors, this fusion transforms virtual properties into pathways to tangible brand benefits, enhancing the value that straightforward digital assets do not provide.

Tangible Utility Over Speculation

The best virtual real estate investors prioritize utility over market buzz. This involves acquiring properties designed for specific purposes: virtual workspaces for remote teams, educational centers for high-end workshops, or gaming venues for esports competitions. These environments create reliable cash flow, converting digital holdings into revenue-generating investments. For high-net-worth individuals, this evolution changes virtual real estate from a speculative risk to a calculated asset.

Curation: The Art of Digital Portfolio Building

Similar to assembling a prime art collection, developing a virtual real estate portfolio necessitates discernment and understanding. Astute investors combine high-traffic commercial areas with unique residential properties, striking a balance between immediate income and future value increase. They favor platforms with robust governance and user growth, ensuring their digital holdings remain relevant as the metaverse progresses. This thoughtful strategy reflects how elite investors craft physical asset portfolios—with a focus on quality and enduring value.

Legacy in the Digital Age

Ultimately, virtual real estate is centered on establishing a lasting digital legacy. Unlike cryptocurrencies that can experience erratic price changes, carefully selected virtual properties characterized by functionality and exclusivity retain value through generations. They evolve into digital estates that can be inherited, rented, or utilized differently, akin to traditional land. For those keen on making a significant impact in both the physical and digital realms, virtual real estate presents the ideal confluence of innovation and legacy.

(Writer:Lorik)